ATTENTION: MEDICAL PROFESSIONALS WHO WANT TO BUILD WEALTH & FREEDOM

How Australia's Smartest Medical Professionals Are Quietly Building $5-6M+ Property Portfolios In Australia With MedInvestPro™

...Without Wasting Time, Chasing Listings Or Making Expensive Mistakes

The Exact Wealth Building Strategy Being Used By Australia's High-Income Medical Professionals To Build Freedom — Without Wasting Time Or Making Expensive Mistakes

See How Australia’s Smartest Medical Specialists Are Growing Equity And Building Long-Term Wealth While Reducing Tax

Book A Complimentary Discovery Chat To Learn The Exact Steps They’re Using To Build Strategic Portfolios In Australia

Learn How Leading Medical Professionals Are Building Strategic Property Portfolios...

Discover The Exact System Top Doctors Use To Secure Investment Property Portfolios Worth Over $5M — Without Sacrificing Time Or Focus

You’ll uncover the proven process used by Australia’s top surgeons, GPs and specialists to grow long-term wealth — without the stress, guesswork or distraction from their careers.

Here’s The Exact System We Build For Australia’s Smartest Medical Professionals — And What It Can Look Like For You In The First 30 Days

Your Personalised Wealth Strategy Roadmap

We start by helping you gain clarity around your property goals, future vision, and ideal lifestyle.

From there, we outline a tailored investment roadmap designed to grow your wealth with minimal time involvement.

Every step is aligned with your income, risk appetite, and long-term aspirations — whether that’s capital growth, passive income, or tax efficiency.

Your Investment-Grade Property Acquisition Plan

Once your strategy is mapped, we help you identify and secure high-performing, investment-grade properties in select Australian markets — aligned to your specific goals.

This includes suburb selection based on capital growth and rental yield insights, access to on and off market opportunities, and full acquisition management — saving you countless hours.

Your End-To-End Due Diligence & Negotiation Process

For every property to be purchased, we apply our rigorous 47-point due diligence process to reduce risk and protect your investment.

We also provide expert price appraisals, negotiate on your behalf, and coordinate all legal, finance and purchase steps — ensuring the property stacks up financially and performs long term.

Your Hands-Free Portfolio Activation

Once the property is secured, we bring everything together for a seamless transition into your portfolio.

That includes finance structuring, legal coordination, referring you for property management and depreciation

— so your asset is activated and managed with minimal input from you.

Your Long-Term Wealth Growth System

After your first property is settled, we support you with a long-term scaling strategy.

Whether you want to reinvest, leverage equity or diversify your holdings, we remain your expert partner in building sustainable, low-stress wealth that works around your medical career.

From The Desk Of The

Property Wizards Team

11 Times Buyer's Agent of the Year

2 National Titles

Buyer's Agent Hall of Fame

Medical Investment Property Specialists

The biggest challenge successful medical professionals face when it comes to building wealth?

Time.

Between clinics, surgeries, patients, CPD, and family, there’s simply no bandwidth to research investment strategies, study market data, deal with agents, or negotiate property deals.

And yet, the desire to grow long-term wealth, reduce tax, and secure financial freedom is stronger than ever.

Here’s what typically happens...

You’ve got a solid income, but your money sits idle or gets funnelled into underperforming assets. You want to invest in property — maybe you’ve tried — but the process is overwhelming, high-risk, and incredibly time-consuming. One missed detail, one wrong location, one underperforming asset... and the consequences can be costly.

The truth?

It’s not your fault.

You’ve spent your life mastering your profession — not becoming a property strategist. And you shouldn’t have to.

There are books, webinars and investment "courses" out there that claim to teach you how to do it all. But let’s be honest — you don’t have the time or energy to become an expert in due diligence, capital growth trends, suburb profiling, or SMSF investing.

That’s where we’re different.

With MedInvestPro™, we turn property investing into a hands-free, professionally managed wealth-building system — tailored specifically for time-pressed, high-income medical professionals.

We do the heavy lifting.

We build the strategy.

We find the properties.

We manage the process.

And we align every decision to your lifestyle, career and long-term financial goals.

With over $500M in transactions, 47-point due diligence, and a multi-award-winning buying process — this isn’t just theory. It’s a proven system that’s helped surgeons, GPs, pharmacists, and other specialists build strategic portfolios without burning out or making avoidable mistakes.

If you’re serious about turning your income into lasting wealth — without sacrificing your time, energy, or focus — we’re ready to help.

This is the exact system that many of Australia’s top specialists are already using to quietly build wealth in the background — and now, we’d love to show you how it can work for you too.

Let’s build your portfolio the right way.

"We Take This Strategic Property Investment System And Build It Around Your Financial Goals, For You"

You don’t have to spend your limited free time researching markets, analysing property data or trying to figure out which suburb might give you the best return.

Strategic property investment is our area of expertise.

This is the same strategic framework that’s helping top-performing medical professionals build high-growth portfolios while staying laser-focused on their careers.

Having worked with high-income medical professionals for over two decades, we know exactly what works — and more importantly, what doesn’t.

We’ve refined a proven, data-driven buying system backed by over $500M in successful transactions and tailored it specifically to help doctors, surgeons and specialists build wealth in the background without distraction.

We bring our proprietary frameworks, trusted partnerships, and full-service process into your world — aligning every step with your career, lifestyle and long-term property wealth vision.

Sure, you could try and piece it all together yourself — reading books, attending seminars, hoping you make the right property decisions without costly consequences…

Or you can shortcut the entire process by working with seasoned experts who do this every day — sourcing high-growth properties, performing meticulous due diligence, managing the entire acquisition, and coordinating all the moving parts for you.

You’ve worked hard to earn your income — now it’s time to put that income to work for you, safely and strategically.

We build your wealth engine for you — and we build it to last.

But Don't Just Take Our Word For It....

Execution Case Studies

42% Capital Growth In 3.5 Years — With A Strategy Focused On Long-Term Wealth, Not Development

This GP and his rheumatologist wife came to us looking for a growth-focused investment that would perform long term without requiring them to manage renovations or developments themselves.

We sourced an add-value property in a tightly held, blue-chip location — one with strong long-term growth drivers. The initial rental yield was low (as expected in prime areas), but the property came with strong tax benefits and capital growth potential.

Over just 3.5 years, the property has delivered 10.7% annual growth — equating to a 42% increase in value. Rental income has now improved to 4.8% of the original purchase price, turning what began as a strategic long-term play into an asset that delivers on both growth and cash flow.

This is a textbook example of how the right strategy, backed by expert guidance, delivers powerful results for busy medical professionals — without the distractions or risks of going it alone.

We Personally Use The Exact Property Strategy Framework We Deliver To Our Clients

We don’t just recommend this process — we live it. Our own leadership team has built multi-property portfolios using the exact strategy and system we deploy for our clients.

From strategic suburb selection to our rigorous due diligence framework, from sourcing the deals to finance and legal structuring, adding value and diversifying — every part of the process has been stress-tested and refined through our own investments. That’s how we know what works.

Our own portfolios include properties that have more than doubled in value, delivered reliable passive income, and created long-term wealth — and we’ve built them while running a successful advisory business. So yes — we know how to do this around a demanding schedule.

When you book your Discovery Call, we’ll show you what’s possible and walk you through the same system we’ve used ourselves — step by step.

"Build A High-Growth Property Portfolio On Autopilot With A Proven System Designed For Busy Medical Professionals"

The key to building lasting wealth is a strategic, stress-free investment system.

With MedInvestPro™, we deploy a proven end-to-end process — from personalised strategy to property acquisition and management — all aligned to your financial goals.

In our first meeting we will discuss strategies and within 30 days we will be searching for your first property, taking the guesswork out of property investing.

You stay focused on your career — we build your wealth in the background.

Learn How The Smartest Doctors Are Building Long-Term Wealth Through Strategic Property Investing — Without Sacrificing Time, Focus, Or Lifestyle

MedInvestPro™ reveals the proven system Australia’s most successful doctors use to build high-performing property portfolios — without the stress, time investment, or risk of doing it alone.

It’s how leading medical professionals convert income into long-term wealth, while staying focused on their careers.

The MedInvestPro™ Portfolio Acquisition Process

Clarify Your Financial Vision

Everything begins with clarity. We take the time to understand your income, goals, career demands, and what “freedom” truly looks like for you.

Whether your focus is long-term capital growth, passive income, tax optimisation — or all three — this step ensures your entire investment strategy is tailored to support your lifestyle and legacy.

Build Your Wealth Roadmap

Next, we discuss your strategy roadmap built specifically around your financial goals.

This includes data-driven suburb selection, the right property types for your desired outcomes, and strategic acquisition planning.

You’ll know exactly what to buy, where to buy, and why — all designed for maximum growth and minimal guesswork.

Activate The Acquisition System

With strategy in hand, we begin sourcing investment-grade properties — both on and off-market — that match your criteria.

Every deal is vetted through our 47-point due diligence process, appraised for value, and negotiated by our expert team. We manage contracts, inspections, and secure the property for you — no overwhelm, no wasted time.

Coordinate The Ecosystem

Once a property is secured, we seamlessly coordinate everything — finance, inspections, contract conditions and property management — through our trusted network of professionals.

You don’t need to chase down brokers or deal with admin headaches. Every step is handled for you by specialists who understand the medical profession and your time constraints.

Scale Your Portfolio And Build Long-Term Wealth

As your first property performs, we help you strategically scale your portfolio over time — whether that’s through equity, leverage, or cashflow reinvestment.

We remain your long-term partner, guiding each acquisition, refining your strategy, and supporting you to build a multi-property portfolio designed for sustainable wealth, lifestyle freedom, and early retirement.

Client Results:

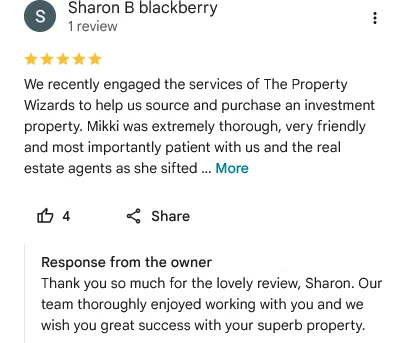

Check Out Some Feedback Provided By Our Clients...

Frequently Asked Questions:

I’m extremely pushed for time — how much time will I need to be involved in this process?

Very little. MedInvestPro™ is a fully managed service. After our initial strategy session and vision planning, we handle everything — from research and property selection to negotiation, contracts, and ongoing management. You stay in control without needing to be hands-on.

Do I need to have prior experience in property investing?

Not at all. Many of our clients are first-time investors or have limited experience. Our team guides you through every step and makes informed decisions on your behalf, backed by 21+ years of expertise and a proven due diligence process.

How do you choose which properties to recommend?

We use a data-backed, strategic selection process tailored to your goals — whether that’s capital growth, rental yield, or a mix of both. Each property goes through our 47-point due diligence check, including location analytics, asset quality, rental demand, and long-term growth potential.

Can I use my Self-Managed Super Fund (SMSF) to invest?

Yes. We frequently work with clients investing via SMSF. We coordinate with SMSF finance specialists and legal professionals to ensure compliance while helping you secure high-performing assets inside your fund.

How much capital do I need to get started?

Typically, clients need at least around $150K–$250K in available equity or savings, but we’ll assess your position and tailor a strategy accordingly. We also work with specialist mortgage brokers to maximise your borrowing power.

Do you also handle the finance, legal and property management side of things?

Yes — we coordinate all of it for you. We work closely with trusted finance brokers, solicitors, and property managers who understand the unique needs of medical professionals. You don’t have to chase anyone — we streamline it for you.

What cities or areas do you specialise in?

We focus on high-growth, investment-grade suburbs in Perth and Melbourne — two of Australia’s most consistently performing markets. Our local expertise allows us to access on-market, off-market and pre-market opportunities most buyers never see.

How long does it take to secure my first investment property?

From initial consultation to purchase, most clients secure their first property within 30–90 days, depending on market conditions and finance pre-approval. Once the strategy is in place, we move quickly — but never compromise on quality.

What ongoing support do I receive after my property is purchased?

MedInvestPro™ is a long-term partnership. We support you beyond the purchase — including strategic scaling, and guidance on your next acquisition when you’re ready.

How do I know this is the right investment strategy for me?

If you're a medical professional looking to build wealth without sacrificing your time, this system is built specifically for you. With over $500M in transactions, industry awards, and decades of success, we provide a low-risk, high-impact pathway to financial freedom — backed by results.

© Copyright 2025 Property Wizards. All rights reserved.

Reproduction or duplication of this website or contents is strictly prohibited.

View Privacy Policy & Terms

Disclaimer: Results apply to each person based on their circumstances and current market situation

.